Smart contracts based totally on blockchain era can effectively prevent postponement in bills for brought goods and make it impossible to unilaterally modify authentic contracts, a local suppose tank stated on Sunday.

The report via Korea Small Business Institute (KOSBI) stated that blockchains could open new horizons for the way small and medium organizations (SMEs) conduct enterprise with their large contractors and reviews Yonhap news corporation.

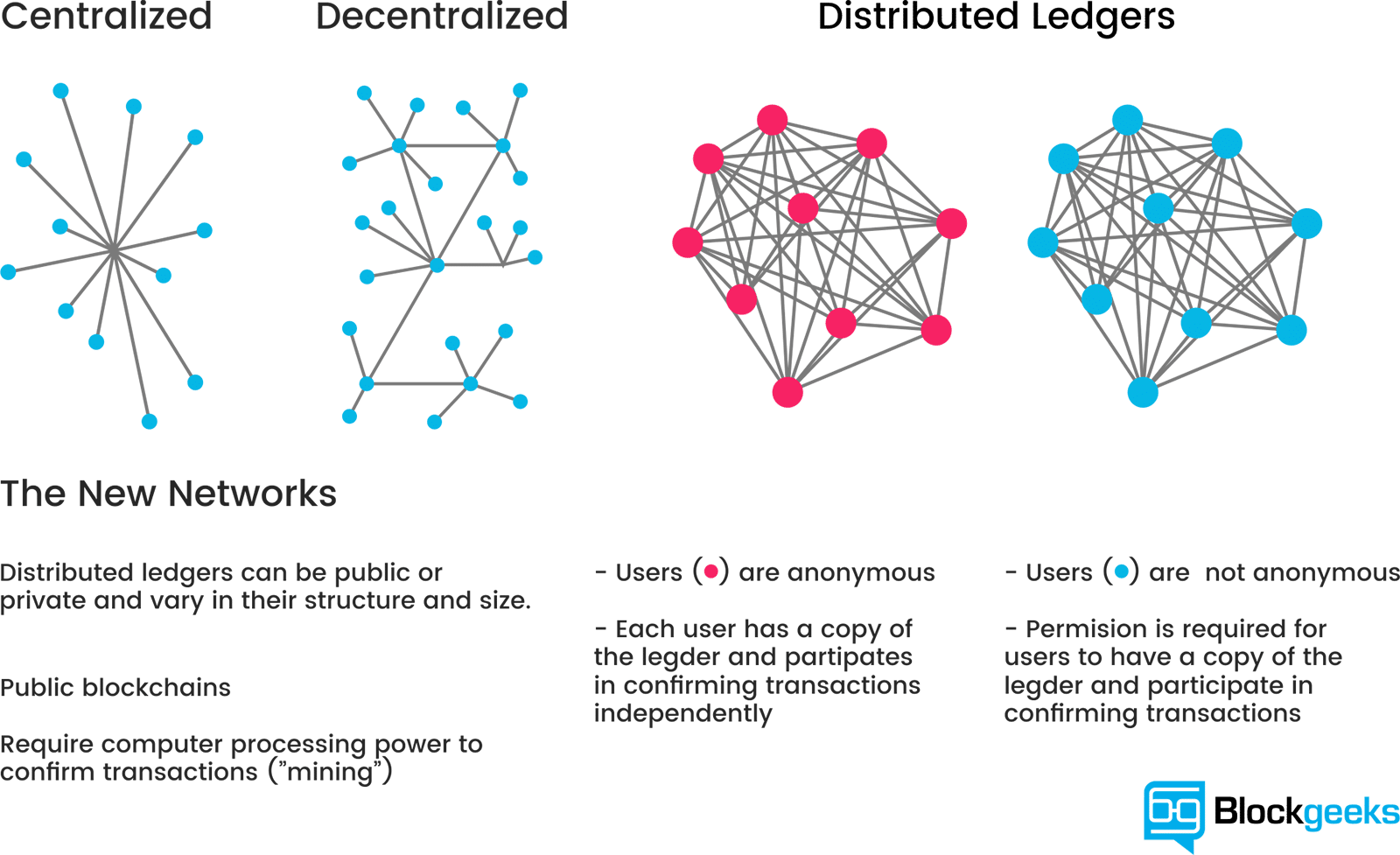

The device is designed for a huge range of data sharing among a wide variety of computer systems linked together in a “chain” that theoretically cannot be tampered with.

Park Jae-sung, a research fellow at KOSBI, claimed that a contract allotted through the blockchain machine would make the delayed charge and unilateral converting of a deal an aspect of the past.

He brought that because smart contracts that are connected to digital currency may be set in advance, so instant payments are made when contractual situations are met, there is no way for a big company to withhold or put off charge. “To create such an environment, it’s miles vital that a sort of public blockchain be advanced and installation so organizations could use it,” the research fellow changed into quoted as saying.

He stated that the first clever agreement has to be reached between SMEs and the government and country-run companies to check their feasibility and application.

In addition, the researcher stressed that blockchains are extensively hailed as a next-technology era that can bring about great innovation.

Small and Medium-sized Enterprises (SMEs) have lots on their plate to worry about, from scalability to inner conflicts. In the midst of such concerning problems, another essential each day problem is going overlooked, this is Expense Management. In the digitized age, the manual technique of filing reimbursements, fee control, and verification is an indication of the old method. It requires the automation of the procedure to limit the paintings on both ends- employees and bosses. Imagine pass verifying all of the documents, payments, and receipts to approve the reimbursements that look as if a tiring undertaking and consequences in a decrease in productivity. According to these days conducted Small Business Accounting survey, only forty-two % of SMEs have given enough thought and importance to appointing a Chief Finance Officer (CFO), which drops to twenty-five% for agencies under 25 personnel.

Read More Articles :

- Changing for the Sake of Changing – Internet of Things Will Be the Same in 2016

- EU companies lash out at new internet privateness guidelines

- Republicans threaten to derail internet transition

- 8 Game-Changing Technology Predictions Of 2016

- Application Monitoring For Improved Application Performance

“Some of the biggest pain-factors small companies have fallen under the economic umbrella,” says Brian Sutter, Marketing Director, Wasp Barcode Technologies. The important accounting challenges for a Small Business consists of- Accounts Collection, Managing Payroll and Paperwork, and Cash waft. Many small commercial enterprise proprietors have shown situation in the direction of the reality that they do not have time to control their books as they are too involved with each day operations, nor they can have the funds for an accountant or full-time bookkeeper, which again factors out the want of introducing Automated Expense Management Tools and digital accountants for small corporations. You could digitize your receipts and organize them on a searchable account. This would suggest the complete techniques could be pulled off without papers.

It isn’t any hidden reality that less paper manner extra productiveness. No greater losing time searching out a receipt filed days in the past. Having it all on a Smartphone makes it a whole lot less difficult and time-saving. In addition to that, such services could make managing cash, growing invoices, and reading worker expenses quicker and a long way more appropriate. The cheating claims with the aid of employees or pending approvals by way of controllers might not be a problem with computerized solutions in the region.

There are solutions inside the marketplace that makes life quite easy! No extra strolling after the boss for following up on reimbursements; add the snap of the receipt, and the job is done. Also, one of the foremost demanding situations for any boss has been retaining employee happiness, and it requires paramount attempts to accomplish that. Fastening the price management strategies might not handiest make for a good boss; however, boom the crew’s productivity with a free-minded technique.

About forty% SMEs are on cloud-based monetary answers, with that wide variety anticipated to be double by 2020. So what is your business watching for? Now is the time to take the leap in the direction of automated fee control answers and welcome a trouble-free method.

Happay is a Bangalore primarily-based payment corporation that gives a unique commercial enterprise cost control answer interlinked to a Visa card. Employees make business fees (meals, travel, fuel, resort, and so forth) with the Happay card and put up charges on the pass. Employers load playing cards, set limits, music charges, and approve reports right away via Happy’s net and cell dashboard. 500+ agencies throughout 10 enterprise verticals, including hyperlocal transport, retail, hospitality, e-commerce, healthcare, education, and so on. Use Happay to make their price management workflow cashless, paperless and mobile.

The contemporary financial weather is leaving many organizations with some tough alternatives. But we ought to not lose sight of the fact that the global economic system is cyclic, which means it’ll rebind and while it does, matters will exchange; the sector it’s human beings, it is companies, in reality, the whole thing changes and the whole thing evolves.

This quick article on preventing the threats to commercial enterprise achievement is aimed in particular at Small to Medium Enterprises (SMEs) who, even though they will be small, collectively are the lifeblood of the British financial system. In 2007 89% of all groups in the UK had less than 10 employees and companies, with over 250 employees accounting for only 0.Four% of the two.16m businesses in the UK. Of these 2.16m businesses, the handiest forty-one .2% were over 10 years vintage.

SMEs are the lifeblood of the financial system; they provide jobs; however, more importantly, they drive through an exchange. In many ways, an SME is spared the limitations of its larger counterpart, so it can react and take the gain of marketplace forces to a greater volume (all matters are relative to the route). Unfortunately, the agility and growth of an SME generally method hits a brick wall as it tries to make it bigger. Unlike big enterprises, SMEs generally tend to preserve their flexibility because they lack the internal infrastructure and formalized approaches, which is one factor causing such a lot to fail.